The TDFI binary options strategy uses a unique combination of precise arrow indicator signals and a built-in oscillator that acts as a filter. Thanks to this, it is possible to get rid of most of the false trading signals , which makes this free trading strategy especially attractive for beginners. Read our review to find out which parameters have a key impact on the results of binary options trading using this system and how to set them up correctly.

Content:

- Characteristics

- Installation

- Overview and Settings

- TDFI Trading Rules

- Specifics of Application

- Conclusion

- Download TDFI

Characteristics of the TDFI Binary Options Strategy

- Terminal: MetaTrader 4

- Timeframe: M1

- Expiration: 3 candles

- Option Types: Put/Put

- Indicators: !Trend direction+force index avgs (multi symbol+mt+alerts+arrows + btn).ex4, !force avgs - floating levels.ex4

- Trading instruments: currency pairs , commodities, cryptocurrencies , stocks

- Trading hours: 8:00 - 21:00 Moscow time

- Recommended brokers: Quotex, Pocket Option, Alpari, Binarium

Setting Up a Strategy for TDFI Binary Options

TDFI strategy indicators are installed in the Metatrader 4 platform as standard. To do this, you need to add them to the root folder of the terminal by selecting “File” in MT4 and then “Open data directory”. In the opened directory, you need to go to the “MQL4” folder and then to “Indicators”, then move all the files there. Templates are installed in the same way, but are placed in the “templates” folder. You can read the installation instructions in more detail in our video:

TDFI Binary Options Strategy Review and Settings

The TDFI binary options strategy consists of two custom indicators. One of them is Trend Direction+Force Index Avgs, which is quite complex and multifunctional, with a large number of settings. The second one is !Force Avgs-Floating Levels, which is a regular auxiliary oscillator with two moving averages.

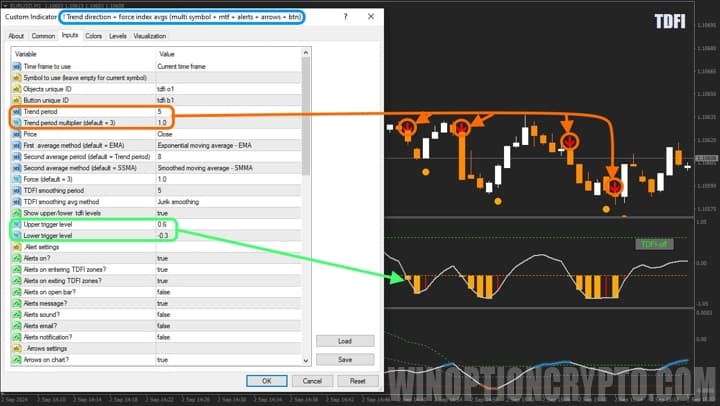

The main attention should be paid to the first instrument, since it is the one that generates trading signals for opening Call and Put options. At the same time, the signals themselves depend on the following parameters: Trend Period, Trend Period Multiplier, Second Average Period, Second Average Method, Force, TDFI Smoothing Period, TDFI Smoothing Avg Method.

By going through these settings, you can find the optimal combination for a specific asset. To make it easier for you to restore all the parameters of the indicators used in this review, you will find a template with all the saved settings in the download archive at the end of the article. Please note that you should not rename the indicators of this strategy, otherwise they will stop working.

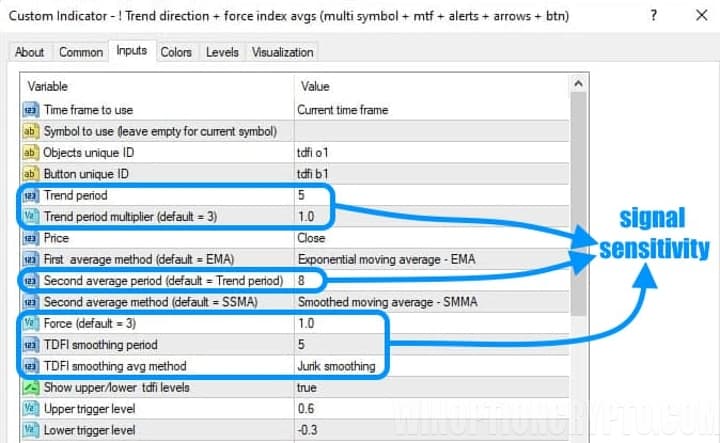

The second oscillator !Force Avgs is designed to filter the signals of the main indicator. Its key parameters, marked in the screenshot below, determine the sensitivity of this tool.

Select them in such a way that the orange line of this indicator corresponds as much as possible to profitable transactions for buying Put options, and the blue line – for buying Call options.

TDFI Trading Rules

The TDFI binary options trading strategy is a system based on technical analysis. Therefore, to help you understand it, we recommend that you read a selection of articles on this topic:

- Technical Analysis of Binary Options

- Technical analysis of cryptocurrencies

- Autochartist: Technical Analysis on Automation

- Book by D. Murphy "Intermarket Technical Analysis"

We will buy Call options when a blue arrow appears under the candle in combination with the blue line of the auxiliary oscillator !Force Avgs, and Put options - when a red arrow appears above the candle and the orange line of the oscillator. In all other cases, according to this strategy, the market is in a flat, and opening transactions is not recommended.

Opening a Call Option

- The oscillator line !Force Avgs is blue

- A blue arrow appeared under the candle

- At the opening of the next candle we buy Call

Opening a Put Option

- Oscillator line !Force Avgs red

- A red arrow appeared above the candle

- At the opening of the next candle we buy Put

It is recommended to select the expiration time of 3 candles. Select the holding period of positions depending on the financial instrument and the results of testing on historical data.

Specifics of Using the TDFI Binary Options Strategy

The TDFI binary options strategy is quite simple, but to use it effectively you should follow certain rules: choose assets with a stable long-term trend , trade only during active market hours and monitor the percentage of payouts on trades - do not trade if this figure falls below 75%.

Advantages of TDFI Strategy

The main advantage of this system is simple trading signals accompanied by alerts, which makes trading especially pleasant and comfortable. Thanks to this, the strategy can be successfully applied to various financial instruments, such as currency pairs , stocks, commodities and cryptocurrencies .

Disadvantages of TDFI Strategy

Like any trend following strategy, the TDFI system generates false signals in flats . Moreover, its effectiveness can be significantly reduced during periods of low volatility . In addition, due to the built-in filter – the !Force Avgs oscillator – traders are sometimes forced to miss part of the trend and the profitable trades that arise on it.

Conclusion

The TDFI binary options strategy belongs to the category of trend systems and is a simple, but at the same time effective trading method. To increase the percentage of profitable transactions, a special oscillator with two auxiliary moving averages has been added to the system.

Setting up the key parameters of the signal indicator will allow you to adapt trading signals to a specific asset, and built-in alerts will help you not to miss potentially profitable deals. Another advantage of the strategy is that it is free. However, before using it in practice, we recommend practicing on a demo account opened with a broker with a minimum deposit . Make deals, observing the rules of risk and capital management. We wish everyone successful trading!

To leave a comment, you must register or log in to your account.